Best Indiana Sports Betting Sites & Apps 2026

The Indiana sports betting market is thriving and is one of the strongest in the Midwest. This is driven by its early adoption of legal sports betting, competitive tax rate, and robust online sports betting framework. Although robust, it does not allow esports and political betting.

Sports betting sites licensed and regulated in Curacao, Panama, Anjouan, and Mwali offer esports and political betting markets. They also provide high-value bonuses and in-play prop betting on college players, which is prohibited on Indiana-regulated sportsbooks. What betting sites are legal in Indiana? Which of these sites offers the most value for bettors? Is sports betting legal in Indiana, and if so, when was it legalized? Let’s find out.

Best Indiana Sports Betting Sites in 2026

- All

|

BetUS Sports |

125% Bonus on First 3 Deposits |

125% Bonus on First 3 Deposits

|

|

PLAY NOW

NO CODE REQUIRED

|

|

BetNow Sports |

125% Welcome Bonus - Up to $2,500 |

125% Welcome Bonus - Up to $2,500

|

|

PLAY NOW

NO CODE REQUIRED

|

|

BetOnline Sports |

Get Up to $250 in Free Bets |

Get Up to $250 in Free Bets

|

|

PLAY NOW

NO CODE REQUIRED

|

|

MyBookie Sports |

50% Deposit Match Up To $1,000 |

50% Deposit Match Up To $1,000

|

|

PLAY NOW

NO CODE REQUIRED

|

|

Everygame Sports |

100% Signup Bonus Up to $200 |

100% Signup Bonus Up to $200

|

|

PLAY NOW

NO CODE REQUIRED

|

|

BUSR Sports |

100% Welcome Bonus Up To $2,500 |

100% Welcome Bonus Up To $2,500

|

|

PLAY NOW

NO CODE REQUIRED

|

|

SportsBetting |

50% Deposit Match Bonus Up To $1,000 |

50% Deposit Match Bonus Up To $1,000

|

|

PLAY NOW

NO CODE REQUIRED

|

|

XBet Sports |

Get $200 in Bonus Bets |

Get $200 in Bonus Bets

|

|

PLAY NOW

NO CODE REQUIRED

|

|

Bet105 Sports |

50% Deposit Match Up To $100 |

50% Deposit Match Up To $100

|

|

PLAY NOW

NO CODE REQUIRED

|

Is Sports Betting Legal in Indiana in 2026?

Here is a quick overview of everything sports betting in Indiana.

| Type | Availability |

|---|---|

| Retail Sports Betting | ✅ |

| In-State Sportsbooks | ✅ |

| Tribal Casinos with Sportsbooks | ❌ |

| Horse Racing | ✅ |

| College Sports Betting | ✅ |

| Esports | ❌ |

| Politics | ❌` |

| Entertainment | ✅ (Limited to entertainment betting) |

Current Legal Standing of Sportsbetting in IN

Retail and online sports betting in Indiana is legal and live. The Indiana Gaming Commission regulates all online and retail sports betting. The current Indiana sports betting framework allows land-based casinos, racetracks, and off-track betting parlors (OTBs) to apply for sports betting licenses through the Commission.

Each state’s thirteen licensed casinos and two racetracks are allowed to partner with up to three Indiana betting apps, also known as “skins.” This structure means that while there are 15 retail sportsbooks in operation, up to 45 online sportsbooks could be created under these partnerships.

Daily Fantasy Sports (DFS) are legal in Indiana, and they have been since 2016, when then-Governor Mike Pence signed Senate Bill 339 into law, making it the second state to legalize DFS. All Indiana gambling winnings are taxable, and the state’s tax rate of 3.23% applies to almost all of these winnings.

The state does not allow esports betting or betting on athletes younger than 18. Also, people over 21 can legally bet on sports in Indiana.

Recent Indiana Sports Betting Legislation Changes

The most recent development in Indiana sports betting is House Bill 1432, introduced in January 2025 by Rep. Ethan Maning. The bill proposed the legalization of online casino gaming and allowing licensed operators to offer online casino games with a 22-30% tax rate on revenue, with funds supporting local services and problem gambling programs. If passed, this legislation could pave the way for the official launch of IN online casinos, providing players in Indiana with more regulated and secure options for online gaming.

However, as of May 2025, HB 1432 has not been passed and remains under consideration in the Indiana General Assembly due to concerns about gambling addiction and competition with the state’s 13 physical casinos. A prior effort in 2023 (HB 1536) also failed, partly due to a corruption scandal.

When Did Indiana Legalize Sports Betting?

IN sports betting was legalized in May 2019 when then-Governor Eric Holcomb signed House Bill 1015. However, retail sportsbooks did not start operating until September 1, 2029, and online sports betting in Indiana launched a month later.

You can place bets at licensed retail IN sportsbooks located in casinos and off-track betting facilities across the state. Only persons physically located within Indiana are allowed to place bets on state-regulated sportsbooks.

Online betting in Indiana isn’t limited to betting on popular professional leagues (NFL, NBA, MLB, NHL) and college sports teams (e.g., Indiana Hoosiers, Purdue Boilermakers, Notre Dame Fighting Irish). You can also bet on special events like the Academy Awards. However, wagers on high school sports, youth sports, and esports are an exception and aren’t accepted on state-regulated Indiana sports betting sites.

How Do the Gambling Laws in Indiana Compare with Neighboring States

Online betting in Indiana was legalized in 2019, only a year after the Supreme Court repealed the Professional and Amateur Sports Protection Act (PASPA). Thus, it is one of the early adopters of legal sports betting in the Midwest. Is sports betting legal in Indiana’s neighboring states? If so, when did these other states legalize sports betting?

Illinois

Online and retail sports betting in Illinois became legal in 2019 after Gov. J.B. Pritzker signed SB 690. Rivers Casino Des Plaines received the state’s first legal retail sports bet in March 2020, while its first online sportsbook launched in June of the same year. Like Indiana, 21 is the legal age for sports betting.

Kentucky

In-person and online sports betting in Kentucky is legal. The legislation was passed in March 2023, and online betting launched on Sept., 28 of the same year. Bettors can wager on professional and college sports leagues. Anyone older than 18 can bet; however, some state-regulated sportsbooks require users to be at least 21.

Ohio

Gov. Mike DeWine signed HB29 into law on Dec. 22, 2021, making Ohio sports betting legal. Ohio bettors can bet on up to 15 sports betting apps, many offering Daily Fantasy Sports (DFS). However, the state’s sports betting framework allows up to 25 online sports betting sites.

Michigan

Michigan residents can wager on sports at retail sportsbooks in most casinos or online within the state’s borders. Gov. Gretchen Whitmer signed the bill to legalize MI sports betting and online gambling in December 2019.

Can You Play at Online Sportsbooks in Indiana?

Yes, you can. You can bet on professional and college sports at all Indiana betting sites. Indiana betting apps even accept wagers on the Academy Awards. However, you may need to look to offshore sportsbooks if you want more niche betting categories like esports and political betting.

Offshore sportsbooks in Indiana, like BetOnline and BetUS, are licensed and regulated, not just in the US. With a respected license, you’re guaranteed timely payouts, data privacy, and safety.

These IN online sportsbooks operable from anywhere in Indiana offer more attractive welcome bonuses, broader betting markets, and more flexible parlays. They also offer higher max bets, more competitive betting odds, and anonymous payment methods like crypto and gift cards for players who are extra cautious about sharing their banking information.

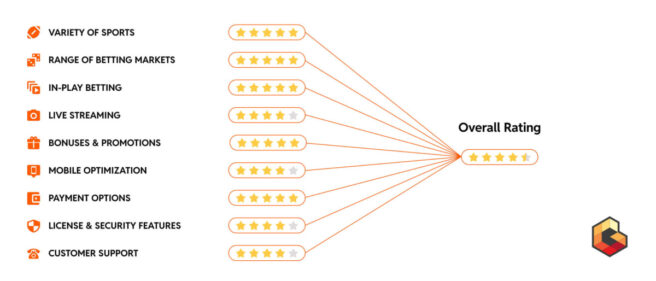

How We Rank the Best Indiana Sportsbooks

Our sports betting experts compiled a selection criteria for what matters, evaluated hundreds of Indiana sports betting apps based on these, and highlighted the top three. These selection criteria include the intrinsic value of its welcome bonus, ongoing bonuses and promotions, range of betting options, in-play betting, live streaming, mobile app optimization, payment options, customer support, licenses, and security features. We fully explained our review methodology on our How We Rank page.

Top 3 Indiana Betting Sites for 2026

We’ve highlighted the best betting sites in Indiana and their stand-out features..

1. BetOnline – Sharp Lines, Live Streaming & Crypto Promos for Serious Indiana Bettors

- Welcome Offer: 50% Welcome Offer up to $250 in Free Bets

- Promo Code: FREE250

BetOnline, established in 1991 and licensed in Panama, is one of the sharpest betting sites in Indiana. It offers early betting lines and rebet functionality. It also offers a cascade of sports-specific promotions and contests to keep bettors winning and engaged.

For regular season games across Indiana popular sports (NFL, NCAAB, NCAAF, and NBA), BetOnline offers a variety of bet types including moneyline, over/under, point spreads, prop bets, parlays, if bets, and teasers. You can bet on these matches pre-game or live. They also offer a live stream on select games, allowing you to watch and stay engaged with your live bets in real time.

BetOnline’s welcome bonus of $250 in free bets isn’t as attractive as those of some of its competitors, but it makes up for this with its numerous ongoing bonuses. You can find many crypto-exclusive promos, reloads, rebates, odds boosts, free-entry contests, and sports-specific promotions here.

2. Everygame – Great for IN Bettors Who Want More Than Just Mainstream Sports

- Welcome Bonus: 50% Bonus up to $200

- Promo Code: Not Required

Everygame is a top pick for Indiana players who like to explore beyond standard NFL or NBA wagers. It features an impressive mix of traditional sports, global leagues, and specialty markets, including politics, pop culture, esports, and niche competitions like snooker and table tennis. If you’re looking for more diverse betting action, this site delivers.

Indiana bettors can access reliable pre-game and live betting markets across the NFL, MLB, NHL, and NCAA, with full support for college matchups and local fan favorites like the Colts, Hoosiers, and Pacers. The platform prioritizes usability over flash, with a clean layout, responsive mobile support, and real-time odds updates.

Banking options are flexible, with both traditional and crypto-friendly choices, including Bitcoin, Litecoin, and AstroPay. The welcome offer includes a 50% bonus with an 8x rollover, which is reasonable for most casual to mid-stakes players. While it may not offer a VIP club, Everygame shines in market depth, ease of use, and betting variety, making it an excellent choice for Indiana bettors who want more than just the basics.

3. BetUS – Deep Market Coverage, Massive Bonuses & Crypto-Friendly Banking

- Welcome Offer: 100$ sign-up bonus up to $2,000

- Promo Code: JOIN125

Available in Indiana for more than three decades, BetUS has blossomed into one of the best Indiana sports betting sites. It is licensed and regulated in Mwali, the Union of Comoros.

The sports betting site offers competitive betting odds on the Colts, Pacers, Hoosiers, Boilermakers, and Notre Dame Fighting Irish. It has deep betting markets on the NBA, NFL, NHL, NCAAB, NCAAF, and MLB. For example, in an NBA game between the Indiana Pacers and the New York Knicks, you can find up to 40+ betting markets to explore. They include moneyline, point spread, totals, winning margin, highest scoring half, margin of victory, and first to score 20 points.

Talking about promotions, there’s a lot to claim. They include a 10% cash bonus, 100% crypto sports bonus up to $1,500, and 100% sports welcome bonus up to $2,000. BetUS also engages bettors with thrilling contests, such as NFL Survivor Pools where you pick a winning team each week to stay in the game, Parlay Challenges for combining multiple bets for bigger payouts, and Betting Squares for major events like the Super Bowl, offering cash prizes and exclusive merchandise.

BetUS lets you deposit money using credit cards, cash transfers, bank wires, or cryptocurrency. There are no fees for crypto deposits, and you can deposit between $20 and $50,000 each day. For other payment methods, the most you can deposit at once is $2,499. Withdrawals are also free; you can take out between $100 and $3,000 daily.

Popular Teams and Events to Bet On in Indiana

Some of the most popular teams backed by locals on the best Indiana sports betting apps include:

Indianapolis Colts

The Colts are Indiana’s flagship NFL team and hold a significant place in the state’s identity. Originally known as the Baltimore Colts (1953-84), the franchise has won three NFL championships and two Super Bowls.

While the team has been rebuilding following Andrew Luck’s sudden retirement, the drafting of quarterback Anthony Richardson has renewed optimism. Divisional matchups in the AFC South also present frequent opportunities for betting the under due to traditionally low-scoring outcomes.

Indiana Pacers

Across the hardwood, the Indiana Pacers embody the state’s basketball fervor, though they’ve yet to capture an NBA Championship. Their glory days came in the American Basketball Association, where they won three titles in 1970, 1972, and 1973 before joining the NBA in 1976.

The Pacers have reached the Eastern Conference Finals in two consecutive years (2023-24, 2024-25). Their current star player, Tyrese Haliburton, is well known for his clutch shot-making and playmaking. Through 11 games in the 2024-25 playoffs, he’s averaged 18.7 points with 5.4 rebounds per game. Tyrera ranks second in playoff efficiency. You can place prop bets on Tyrese on BetOnline.

Indiana Hoosiers

The Indiana Hoosiers basketball team has a proud history, winning five NCAA Championships in 1940, 1953, 1976, 1981, and 1987. The football team won two Big Ten Championships in 1945 and 1967, but never a national title.

In 2024, the football team had a remarkable season under coach Curt Cignetti, finishing with an 11-1 record and earning a spot in the College Football Playoff. Led by quarterback Kurtis Rourke, their high-powered offense averaged 43.3 points per game, ranking second in the nation among top college teams. Their explosive offensive style makes betting on the over, a smart choice for fans and bettors.

Purdue Boilermakers

Purdue’s basketball team, one of Indiana’s best, consistently ranks among the nation’s best. While they’re yet to win an NCAA Championship, they’ve come agonizingly close, most recently in 2024 when they reached the national title game but fell to UConn, the defending champions. Purdue’s 2024-25 season offers plenty of betting opportunities. Their strong ATS record at home (around 60%) and high-scoring style make them a go-to for spread and over bets.

Purdue’s football program has a proud but less consistent history than basketball. They share 12 Big Ten Championships, tied for the third-most in the conference, with their last title in 2000. The 2024 season was a wash, but their history of upsets suggests value in occasional moneyline bets as heavy underdogs at home, particularly against overconfident rivals.

Notre Dame Fighting Irish

Notre Dame’s football team has 11 national championships, the last of which was in 1988 under coach Lou Holtz. In 2024, under coach Marcus Freeman, Notre Dame had a stellar season, finishing 12-3 and reaching the College Football Playoff (CFP) National Championship game. Notre Dame’s defense makes under bets a solid choice, as seven of their 2024 games went under the total points line.

Its basketball team hasn’t matched football’s glory but has a respectable history. They’ve never won an NCAA Championship, with their best runs being Elite Eight appearances in 2015 and 2016 under coach Mike Brey. The women’s team, now led by Niele Ivey, is a more consistent team than the men’s, and offers better moneyline bets potential..

Responsible Gambling at IN Sportsbooks

IN Gambling Help

All our recommended Indiana sports betting sites offer easy-to-use self-exclusion programs to help you take a break from gambling if needed. If those aren’t enough, check out these free resources for extra support:

All our recommended Indiana sports betting sites offer easy-to-use self-exclusion programs to help you take a break from gambling if needed. If those aren’t enough, check out these free resources for extra support:

The Best IN Sportsbooks

Indiana sports bettors are not as boxed in as bettors from other states. They can bet on college sports, daily fantasy sports, and even some entertainment awards on regulated IN online sportsbooks. Still, residents are not allowed to bet in-play on college sports teams. But there are alternatives you can explore – IN online sportsbooks licensed and regulated in respected jurisdictions outside the U.S.

IN online sportsbooks like BetOnline, Everygame, and BetUS offer competitive betting odds on traditional American sports like the NBA, NFL, and NCAAF and international attractions like tennis and cycling. They also offer betting lines on esports and politics. BetOnline, in particular, offers live college prop bets and live streams on select games.

At GamblingIndustryNews, we are committed to promoting responsible gambling. We encourage our readers to play responsibly, never chase losses, and be aware of features like self-exclusion programs that help players to maintain control over their gambling activities and promote a balanced experience. At GamblingIndustryNews, we are committed to promoting responsible gambling. We encourage our readers to play responsibly, never chase losses, and be aware of features like self-exclusion programs that help players to maintain control over their gambling activities and promote a balanced experience.Responsible Gambling

Indiana Sports Betting FAQs

Is sports betting legal in Indiana?

Yes, both online and retail sports betting are legal in Indiana for players 21 and older.

When did Indiana legalize sports betting?

Indiana legalized sports betting in May 2019, with online and retail betting launching later that year.

Can I bet on college sports in Indiana?

Yes, you can bet on college games—but in-play college prop bets are not allowed on regulated sites.

Are there Indiana betting apps I can use?

Yes, several licensed Indiana sports betting apps are available statewide.

Can I bet on esports or politics in Indiana?

No, state-regulated sportsbooks do not allow betting on esports or political events.

Are offshore sportsbooks legal in Indiana?

Yes, Indiana residents can legally use offshore sportsbooks licensed in other jurisdictions.