Penn Entertainment CEO Jay Snowden and Director David Handler bought a combined 44,000 shares after a recent price drop, caused by a report by disgruntled investor HG Vora.

Snowden purchased 34,000 shares of the entertainment, sports, and online casino operator at an average price of $14.699 per share, totaling approximately $499,766. He now owns over a million shares in the company, which saw the price rise to over $15 after the purchases. On May 28 the price was at $15.38.

Handler, meanwhile, bought 10,000 shares, paying $14.83 each for a total of more than $148,000. He now owns 322,941 shares directly and 20,000 indirectly through a foundation.

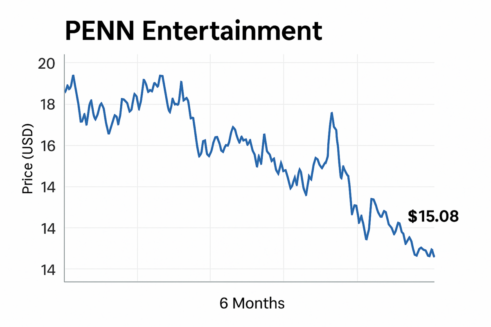

PENN stock continues to crash

The share price dropped last week following a report by HG Vora criticizing the company under Snowden’s leadership. The 116-page document, titled “Genuine Change is Needed at PENN,” highlighted how mistakes have led to the share price plummeting in recent years.

From a price of $0.5 per share in 2000, PENN’s stock saw a gradual rise until 2019, giving investors such as HG Vora high returns of 4926%. Since Snowden was appointed CEO in 2020, however, that trend has reversed, leading to losses of 37% for investors.

The share price hit a high of $130.47 in February 2021 before a crash that has continued until today. Analysts warned the stock was massively overvalued based on its fundamentals, especially given limited profitability from its digital operations. The current price of $15.38 is a 26% decrease from this time last year.

Sports betting strategy a failure

The report particularly criticized PENN’s sports betting failures, noting the $550 million the company paid for Barstool Sports over two phases of investment. The company struggled to obtain gambling licenses due to its controversial image, and PENN sold it back to founder Dave Portnoy for $1 in 2023.

Portnoy commented, “We got denied gambling licenses because of me, you name it. So the regulated industry [is] probably not the best place for Barstool Sports and the type of content we make.”

Portnoy faced a string of sexual harassment allegations in 2021 and 2022, but has not faced any charges as yet. Commenting on the decision to get rid of Barstool Sports, Snowden commented, “Barstool is a great media company, but not the right fit for our long-term sports betting strategy in a regulated market.”

On the same day as the sale, which represented a huge loss for the company, PENN announced a 10-year, $2 billion exclusive partnership with ESPN, launching “ESPN Bet” as its new sportsbook brand.

ESPN Bet continues to lose money

Since the launch in 2023, PENN’s interactive division, encompassing ESPN Bet, theScore Bet, and Hollywood Casino, generated revenue of $960 million in 2024, up from $719 million in 2023. Despite revenue growth, the division’s annual losses increased from $403 million in 2023 to nearly $500 million in 2024.

Growth has continued this year, but not at a quick enough rate. The interactive segment generated $162 million in revenue in Q1, up from $151 million in Q1 2024. This growth was attributed to increased performance from ESPN Bet and online casino platforms. Adjusted EBITDA losses narrowed to $89 million, down from $196 million in Q1 2024, indicating progress toward profitability

As of early 2025, ESPN Bet holds approximately 2–4% of the U.S. online sports betting market share. PENN had set a goal to achieve a 20% market share by 2027, but current trends indicate the platform will struggle to meet this target.

PENN shuffled its board of directors last month, but HG Vora wants more changes at the top to put the company back on a profitable course.