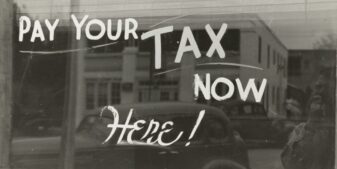

Virtual Gaming Worlds (VGW), the operator behind sweepstakes casinos Chumba Casino, Global Poker, and Luckyland Slots, has announced it will start charging users sales tax on its platforms.

As sweepstakes casinos have been facing increased scrutiny by regulators and lawmakers, the operator hopes the move will prolong its presence in the US gambling market.

Speaking to Sweepsy, a company spokesperson stated, “We acknowledge this is a change for some of our players, but as the legal framework has evolved over time, we’ve determined it is the appropriate time to take this action,”

“This is part of our commitment to upholding the highest standards of integrity and compliance, and our focus now is on ensuring players are well informed and supported as required.”

Terms and Conditions Updated To Add Sales Tax

VGW updated its terms and conditions to include the new tax added to purchases of Gold Coins, which users can use to play online casino games.

The new terms state, “Under certain state laws, Gold Coin purchases may be subject to certain taxes, depending on your location. You agree your purchase of Gold Coins is made with the understanding that such tax will be added at the time of purchase.

“In jurisdictions where tax is not added by us at the time of purchase, you are solely responsible for any taxes applicable from your Participation, including transaction taxes (e.g. sales/use tax, value added taxes or digital sales taxes) applicable to your jurisdiction. Additionally, you are solely responsible for reporting any income and income taxes associated with winning valuable prizes.”

There has been no official announcement detailing the states where users will be charged, but it has been noted that users in Kentucky, Illinois, Arkansas, Pennsylvania, and Hawaii have all been informed that they will be taxed.

A message to users sent out on Wednesday stated, “Please be advised that purchases may be subject to tax depending on your location. Any applicable tax will not be counted toward your purchase limit.”

Tax Aims To Gain Foothold in California Online Gaming

A growing number of states have introduced legislation banning sweepstakes casinos, and an amendment to a bill in California proposes to criminalize the platforms. Being the most populous state in the country, a ban would greatly impact VGW’s business.

In response to the bill, VGW said it would be willing to pay tax in the state. A spokesperson for the company said, “Currently, there is no method for us to pay sales tax in California because ours is a digital product, but this is something we would be happy to do under an appropriate framework. We are also open to other potential sensible taxation frameworks and/or revenue stream to benefit the people of California.”

The company has also urged lawmakers to pause the bill proposing a ban, stating, “Rather than an outright prohibition, VGW and the social online games industry are asking that you park this rushed, gut-and-amend legislation and hear our side of the story,”

“We want to work collaboratively with the California Legislature on sensible legislation that creates a robust regulatory framework prioritizing consumer protection while simultaneously offering a new revenue stream for the state. The economic opportunity is significant. Based on industry projections by Eilers & Krejcik, California could generate annual revenue of $149 million through sale tax alone.”

The bill, AB831, passed the Senate Governmental Organization Committee on Tuesday. It will now go to the Senate Public Safety Committee, with a hearing scheduled for July 15.