A host of military betting markets have emerged on prediction markets sites, and there has been suspicious activity of trading on airstrikes in Israel, suggesting insider information is being used for profit.

At prediction market site Polymarket, which is unlicensed in the US, users can create their own markets and wager on almost anything. With rising tensions in the Middle East, the site features a section dedicated to markets on the political situation:

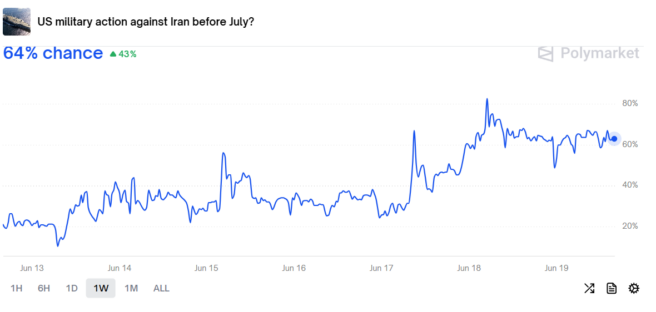

Over $16 million has been traded on whether there will be US military action against Iran before July, with the chance moving from 15% last week to a current 64%. On Wednesday Trump commented, “I may do it. I may not do it. I mean, nobody knows what I’m going to do.”

Markets have also been available on whether Israel will strike Iran, and it has been observed that some accounts have made a lot of money on three different occasions when Israel has taken military action.

Account data highlighted as suspicious

The unusual activity was highlighted by Rajiv Sethi on Substack and notes that an account made a $134,000 profit on Israel’s recent attack on Iran. The account in question was created 24 hours before the attack, “started accumulating contracts at scale about twelve hours before the bombing was initiated, made $134,000 in profits, then cashed out immediately and disappeared from the exchange.”

User @Domahhhh on X, a self-described “Full-time political bettor since 2007,” posted, “I almost never think its an insider. But this has now happened 3x in a row for Israeli strikes — when Israel struck Iran in October 2024, when Israel struck the Houthis a month or two ago, and again for yesterday’s strike. There’s an intel leak somewhere.”

Whether the markets have been hijacked by insiders with additional information or not, the price movements have usually been shown to be valid predictors of many events.

Prediction markets a better guide than TV and polls

Elon Musk previously praised prediction markets, calling their political markets “more accurate than polls”. Musk’s social media platform X recently partnered with Polymarket. A press release commented that “As part of the agreement, Polymarket and 𝕏 are launching an integrated product to deliver data-driven insights and recommendations to Polymarket.”

“Polymarket predictions will be combined with 𝕏 data to provide live insights, incorporating real-time annotations explaining market moves directly from Grok and relevant 𝕏 posts.”

Polymarket adds a note on its markets on the Middle East, justifying the markets as providing valuable insight during “gut-wrenching times”. The full disclaimer reads, “The promise of prediction markets is to harness the wisdom of the crowd to create accurate, unbiased forecasts for the most important events to society.

“That ability is particularly invaluable in gut-wrenching times like today. After discussing with those directly affected by the attacks, who had dozens of questions, we realized that prediction markets could give them the answers they needed in ways TV news and Twitter could not.”

Prediction markets facing strong opposition

Although Polymarket is unregulated in the US, sites under the jurisdiction of the Commodity Futures Trading Commission (CFTC) are facing strong opposition. Kalshi, which gained popularity for its political betting on the US Presidential race last year, has expanded into sports markets.

This week, 34 states, along with the American Gaming Association (AGA) and a host of tribes, filed briefs opposing the platform in a court in New Jersey.

The CFTC previously fined Polymarket $1.4 million in 2022 and ordered it to close U.S.-registered accounts, but it would appear many Americans continue to use the site.

The FBI raided CEO and founder Shayne Coplan’s home last year due to suspicions that the site was allowing users to trade on the presidential race. Despite seizing devices, no further action has been taken to date. Polymarket’s presidential market saw $3.3 billion in trading volume.