Real Money Online Casino Rhode Island 2026: Top 10 Best RI Online Casinos February, 2026

Despite being the smallest US state, Rhode Island has made one of the biggest moves in the iGaming industry by being one of the few states to offer legalized online casino games. This journey began with the launch of two platforms operated by Bally Casino in 2024.

This article provides a comprehensive guide for new gamblers on everything they need to know about the best real money online casino options in Rhode Island. It covers legal developments, comparisons with neighboring states, and highlights the top Rhode Island casino sites, offering a thorough overview for readers ready to explore the state’s online gambling scene.

RI Online Casinos 2026

- All

|

CoinPoker |

150% Deposit Bonus Up To $2,000 |

150% Deposit Bonus Up To $2,000

|

|

PLAY NOW |

|

Raging Bull |

250% Bonus Up To $2,500 + 50 Free Spins |

250% Bonus Up To $2,500 + 50 Free Spins

|

|

PLAY NOW |

|

Lucky Red |

450% up to $4500 |

450% up to $4500

|

|

PLAY NOW |

|

Lucky Creek |

200% Match Bonus Up To $7,500 + 30 Free Spins on Big Game |

200% Match Bonus Up To $7,500 + 30 Free Spins on Big Game

|

|

PLAY NOW |

|

Buffalo Casino |

Welcome Package 500% up to $5,000 |

Welcome Package 500% up to $5,000

|

|

PLAY NOW |

|

TheOnlineCasino US |

400% up to $1,000 |

400% up to $1,000

|

|

PLAY NOW |

|

Slotocash |

$7,777 In Bonuses + 300 Free Spins |

$7,777 In Bonuses + 300 Free Spins

|

|

PLAY NOW |

|

DuckyLuck |

Welcome Package 500% up to $2,500 + 150 FS |

Welcome Package 500% up to $2,500 + 150 FS

|

|

PLAY NOW |

|

VegasCasino Casino |

$9,000 + 200 Free Spins |

$9,000 + 200 Free Spins

|

|

PLAY NOW |

|

Everygame Casino |

Welcome Bonus of 200% up to $2,000 + 40 Free Spins |

Welcome Bonus of 200% up to $2,000 + 40 Free Spins

|

|

PLAY NOW |

Are Online Casinos Legal in Rhode Island?

In 2023, Senate Bill 948 was passed, making Rhode Island the seventh state to legalize online gambling. This marked the launch of the first online casino in Rhode Island for real money.

However, the conditions of this bill are quite unique. Instead of allowing multiple platforms to operate within the state, only Bally’s Corporation has been awarded the rights to run its online gambling platform under the supervision of the Rhode Island Lottery.

Under the new regulations, as the only online casino in Rhode Island for real money, Bally’s can now offer online slots and live dealer games such as blackjack and roulette, providing a mix of classic and interactive options for players. In order to participate, players must meet the age requirement of 21 years or older.

Recent Legislative Updates on Rhode Island Online Casinos

Rhode Island has a somewhat long and varied history when it comes to both gambling and sports betting. The road to legalization was fraught with many hurdles along the way. Here are some of the key milestones in the Rhode Island legislature that led to the introduction of the very first real-money online casino in Rhode Island:

- 1934: Rhode Island first dabbled in legalized gambling when the government introduced pari-mutuel betting on horse racing.

- 1974: The Rhode Island Lottery was established to offer residents access to state-regulated lottery games. This organization’s formation was also crucial for laying out the legal framework for future gambling endeavors, including the first real-money online casino in Rhode Island.

- 2012: Twin River Casino in Lincoln transitions from a racetrack to a full-scale casino, offering table games and slot machines.

- 2016: Daily Fantasy Sports (DFS) were legalized in the Ocean State, which gave residents a taste of what sports betting could offer by allowing them to participate in online fantasy sports competitions.

- 2018: Sports betting is legalized at Rhode Island’s two land-based casinos, Twin River Casino and Tiverton Casino, both operated by Bally’s Corporation.

- 2019: Mobile sports betting is launched, and residents can place bets via their smartphones. The Rhode Island Lottery monitors this mobile betting activity.

- 2020: The first real discussions begin about the potential for online casino legalization, led primarily by Senate President Dominick Ruggerio. This is mainly driven by the success of mobile sports betting and the need for additional state revenue streams.

- 2023: Senate Bill 948 was passed, effectively authorizing Bally Corporation to operate the only legal online casino in Rhode Island for real money.

- 2024: Bally’s real money online casino in Rhode Island launches exclusively, with an extensive selection of slots and live dealer casino games.

- 2025 (Expected): Discussions are ongoing regarding the introduction of additional Rhode Island casinos to the limited market. For now, Bally’s online casino in Rhode Island for real money remains the only state-licensed option.

When Did Rhode Island Legalize Online Casinos?

The first real-money online casino in Rhode Island opened its virtual doors in 2024 following the passage of Senate Bill 948, which was signed by Governor Dan McKee. Bally’s Corporation was granted the exclusive rights to operate online casinos in Rhode Island, and it launched its first online gambling site in May.

The regulatory oversight over Rhode Island’s gambling industry was assigned to the Rhode Island Lottery, the state’s main gambling regulatory body. Under the Rhode Island legislature, individuals who are at least 21 years old can engage in online gambling activities. With options limited to a single real money online casino in Rhode Island, many Rhode Island residents seek iGaming opportunities at the best offshore casinos, which have no legal consequences.

How Do Rhode Island’s Gambling Laws Compare with Neighboring States?

While examining the Rhode Island legislature concerning online gambling activities, we wanted to compare the state’s laws and regulations with those of neighboring states. The table below provides a quick look at how gambling fares in neighboring states and gives some insight into Rhode Island’s position and potential revenue for its own gaming industry.

| State | Laws |

|---|---|

| Connecticut | CT online casinos have been legal since 2021 and have a competitive multiple operator model. They host big-name platforms like DraftKings and FanDuel, which operate under Indigenous tribal agreements and are taxed at 18-20% of revenue. |

| Massachusetts | Massachusetts Online Casinos are not yet legal, but bills introduced in 2025 propose a 20% tax rate and could lead to legalization by 2026. |

| New York | Online casinos remain illegal, with no significant legislative efforts to legalize them. |

Can You Play at Online Casinos in Rhode Island?

Rhode Island is one of the few states in the US where online gambling is actually legal. However, the Rhode Island Lottery currently only endorses two platforms owned by Bally’s Corporation. These platforms are also the only state-licensed options for Rhode Island Sports Betting.

Despite the extensive gaming libraries and rewarding promotional offers, Rhode Island residents might still want a touch of variety. This is why many players opt to play at Rhode Island online casinos licensed by out-of-state iGaming regulatory bodies.

These trusted online casinos offer unique game options, generous bonus deals, and popular US-accepted payment options. Many of these perks are unavailable at Rhode Island’s brick-and-mortar or state-operated online casinos.

It is important to note that there are no legal repercussions against players choosing to play at online casinos based outside the US borders. US gambling laws, including those in Rhode Island, mainly target operators rather than individual players.

Brick and Mortar Casinos in Rhode Island

Rhode Island residents have two amazing alternatives to real money online casinos in Rhode Island, operated by Bally’s Corporation. These full-scale casinos go far beyond what traditional brick-and-mortar venues offer for a premium five-star experience.

Bally’s Tiverton Casino Hotel offers a 38,000-square-foot gaming floor featuring 1,000 slot machines and 32 table games, including popular options like blackjack, roulette, and craps.

The Twin River Casino also offers many options, with over 4,000 electronic gaming machines and 100+ table games. In addition to a variety of slots, table games, and poker, patrons can enjoy fine dining, luxury accommodation, and many other perks for the most immersive gambling experience in Rhode Island.

| Casino | Address |

|---|---|

| Bally’s Twin River Lincoln Casino Resort | 100 Twin River Road, Lincoln, RI 02865 |

| Bally’s Tiverton Casino Hotel | 777 Tiverton Casino Blvd, Tiverton, RI 02878 |

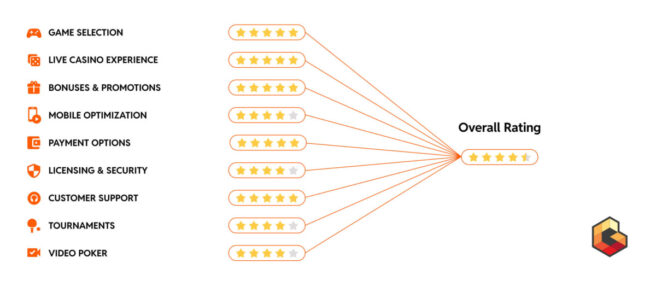

How We Rank the Best Rhode Island Online Casinos?

We apply rigorous criteria to guide you to the best real-money online casino in Rhode Island. Our experts assess each platform’s licensing and regulatory compliance, security measures (like SSL encryption), game variety and software quality, payout speed, and the value of welcome offers plus ongoing promotions. We also look for sites that support both fiat and crypto payments and deliver fast, hassle-free withdrawals. For a full breakdown of our ranking methodology, head over to our How We Rank page.

Top 3 Rhode Island Online Casino Sites for 2025

For 2025, we’ve singled out the three premier online casinos that combine top-tier security, lightning-fast deposits and withdrawals (fiat and crypto), and generous welcome offers plus ongoing rewards, all backed by industry-leading game libraries. Read on to discover which site best matches your playstyle.

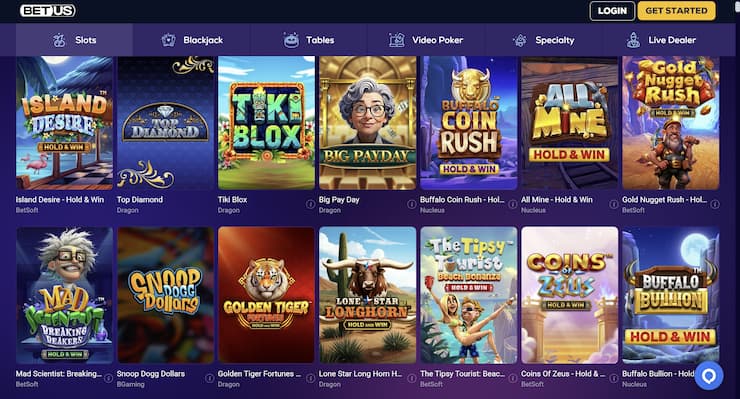

1. BetUS – Best RI Casino for Fast Payouts

- Welcome Bonus: 250% up to $5,000

- Promo Code: CAS 250

BetUS has been in the gaming business for decades, and over these years, they have cemented their place as one of the giants of the online casino industry. With its easy-to-navigate and polished platform, all users will find its processes and menu options easy and intuitive. If you want a straightforward, real-money gaming experience, this online casino in Rhode Island is your best bet.

The game variety offered here is impressive, with a wide range of slots, classic table games like blackjack and roulette, and specialty options like video poker. These are all powered by top industry developers such as Rival and DGS. Look out for high payout options like their collection of progressive jackpot slots, like Major Moolah. Whether you are depositing with crypto, credit cards, or bank transfers, you will only find fast, secure, and hassle-free payment processes here.

BetUS is an expert in promotions and knows exactly how to reward its players. The welcome offer of 250% up to $5,000 is complemented by regular weekly promos, including cash reload bonuses and free spin offers. Their license by the Comoros Union’s authority guarantees player safety and game fairness, making BetUS a safe and exciting choice for Rhode Island residents interested in exciting online gambling sessions.

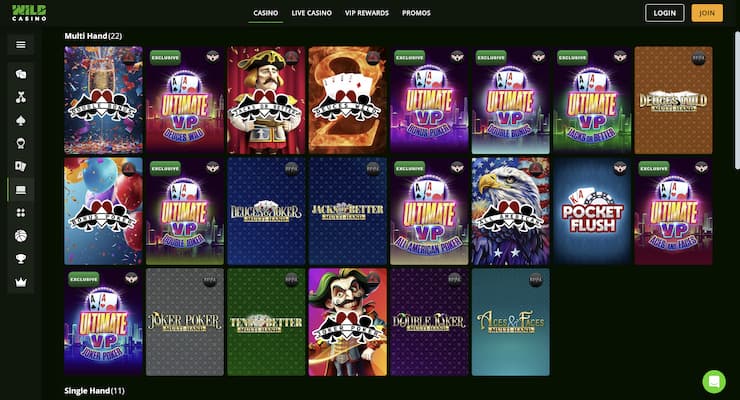

2. Wild Casino – Top Crypto Casino for RI Players

- Welcome Bonus: Up to 250 Free Spins

- Promo Codes: N/A

Wild Casino has been a paradise for online casino players in Rhode Island ever since its launch in 2018. It offers smooth and responsive mobile and desktop play, as well as a well-organized website. Their focus on crypto gaming is what makes them stand out in Rhode Island’s gambling industry. Their gaming library boasts over 2,500 games and caters to every taste.

Whether you are a fan of classic reels or modern video slots with interactive bonus features, there is an option for everyone. They also offer a solid collection of table and live dealer games with options like blackjack, roulette, craps, and more. These are all powered by leading names like BetSoft and RealTime Gaming. Now on to the real shining star, the platform’s generous crypto bonus. This offer gives newbies a strong start, with the standard welcome offer of 250 Free Spins, without any rollover requirements.

Their banking options are just as impressive, with more than 15 payment methods supported, including Bitcoin, credit cards, and standard bank wires. This is an essential component of every top-tier real-money online casino in Rhode Island.

3. Raging Bull – Best RI Casino for Table Game Fans

- Welcome Bonus: 250% and 50 Free Spins

- Promo Code: Mighty250

Raging Bull is a must-try for fans of table games. Raging Bull is licensed by the Autonomous Island of Anjouan, Union of Comoros, and they offer top-notch gameplay coupled with a user-friendly design. You can be sure that your financial and personal data are safe thanks to the platform’s use of advanced SSL encryption and other advanced security measures. Its sleek and modern interface also appeals to players and is highly optimized for mobile gaming.

The game library at this real money online casino in Rhode Island leans heavily on table games, and players can find multiple variants of blackjack, poker, baccarat, and roulette. Beyond these classics, there is an interesting mix of video slots and specialty games like scratch cards and game shows. For those who prefer a more social gaming experience, there is an extensive collection of live dealer titles. Real Time Gaming, a trusted name in the industry, powers all of these games.

Raging Bull’s 250% welcome bonus and 50 Free Spins are exciting offers for new players, and they boost their bankroll. This gives players with a smaller budget the confidence to explore and try out options that they usually would not risk. There are also a number of ongoing reload bonuses and loyalty rewards that ensure players always have something to look forward to. This fast payout casino site supports various payment methods, including crypto and traditional fiat options, with fast payouts and minimal delays, regardless of which withdrawal option you choose.

Popular Casino Games to Bet on in Rhode Island

A recent study from 2024 demonstrated that Rhode Island players have some clear favorites in mind when it comes to casino games.

The most searched games included slots, blackjack, and poker. Players in the region seem to love a balanced mix of chance, strategy, and excitement.

Slots

Slots continue to dominate Rhode Island players’ preferences, and were consistently among the top searched games for Rhode Island residents. Their simplicity and the potential for massive payouts make them an appealing option.

Plus, these days, slots come with countless themes, pay lines, and innovative bonus rounds, making them even more rewarding. For the best slot experience, BetUS leads the pack with its comprehensive collection of classic, video, and jackpot slots, all powered by top-tier developers.

You will find popular titles such as Wheel of Fortune, Huff n’ Even More Puff, and Buffalo Link, which offer excitement and the chance to win big.

Blackjack

Blackjack’s unique combination of strategy and straightforward gameplay is what makes it such a classic. Its popularity has remained strong among Rhode Island players, despite the large influx of newer and flashier gaming options.

Raging Bull Casino, in particular, is a haven for blackjack fans. It offers a number of variants from traditional blackjack to more exciting options like Absolute Blackjack, which allows unlimited players at virtual tables, and live dealer blackjack tables, where players can interact with real dealers and other players.

Video Poker

Video poker is another popular choice for Rhode Island casino players. These kinds of games blend the thrill of slots with all of the strategy that usually comes with a round of poker.

Iconic games like Ultimate X Poker, Super Times Pay Poker, and Dream Card Poker at BetUS make up the most searched for options by residents of the Ocean State. These exciting titles offer unique gameplay mechanics and highly lucrative payouts.

For instance, Ultimate X Poker offers multipliers that elevate the excitement with every deal, while Super Times Pay Poker rewards players with bonus multipliers during specific rounds. Dream Card Poker brings a distinct edge by introducing a wildcard element that enhances winning combinations.

Responsible Gambling Resources in Rhode Island

Online gambling in Rhode Island, or anywhere else for that matter, is just a form of entertainment, a great way to socialize with friends, and experience some excitement. Gambling should never be the cause of stress or financial worries. The minute it starts to feel like it is more, or a way to get rich quickly, it is time to take a break.

Thankfully, RI has several useful options to help players control their gambling habits. Many Rhode Island-friendly online casinos offer helpful tools like spending limits, self-exclusion programs, and cooling-off periods, which are readily available at the best real-money online casino in Rhode Island.

RI Gambling Help

If you feel like you are losing control, there are also free, confidential resources where you can get judgment-free support. These include:

- National Problem Gambling Helpline (1-800-GAMBLER): A 24/7 service that connects you with support networks across the USA.

- Rhode Island Problem Gambling Helpline (401-499-2472): This is a local helpline that offers guidance, counseling, and a number of valuable resources and tools.

- Rhode Island Council on Problem Gambling: This organization provides education, resources, and self-help tools for Rhode Island’s residents.

If you feel like you are losing control, there are also free, confidential resources where you can get judgment-free support. These include:

- National Problem Gambling Helpline (1-800-GAMBLER): A 24/7 service that connects you with support networks across the USA.

- Rhode Island Problem Gambling Helpline (401-499-2472): This is a local helpline that offers guidance, counseling, and a number of valuable resources and tools.

- Rhode Island Council on Problem Gambling: This organization provides education, resources, and self-help tools for Rhode Island’s residents.

Final Thoughts: The Best RI Online Casino

After reviewing the top options for Rhode Island online casinos, it is clear why BetUS earns the #1 spot on our list of real money online casinos in Rhode Island.

Its decades of experience, backed by a stellar reputation and a unique mix of innovative features, make it a must-try option for any Rhode Island online casino player. In particular, its generous welcome bonus of 250% match up to $5,000, along with attractive terms and conditions, tipped the scales in the casino’s favor.

Plus, their wide selection of casino games, including live dealer options, ensures hours of thrilling fun. Add to that their cryptocurrency support and super-fast transaction speeds, and you will be a real winner.

BetUS is truly cut above the rest, and Rhode Island players looking for variety and rewards will not find a better pick.

At GamblingIndustryNews, we are committed to promoting responsible gambling. We encourage our readers to play responsibly, never chase losses, and be aware of features like self-exclusion programs that help players to maintain control over their gambling activities and promote a balanced experience. At GamblingIndustryNews, we are committed to promoting responsible gambling. We encourage our readers to play responsibly, never chase losses, and be aware of features like self-exclusion programs that help players to maintain control over their gambling activities and promote a balanced experience.Responsible Gambling

Rhode Island Online Casinos FAQs

Are real money online casinos legal in Rhode Island?

Yes, real money online casinos are legal in Rhode Island. However, Bally’s Corporation is currently the state’s exclusive operator for licensed online casino platforms under supervision from the Rhode Island Lottery.

What are the best Rhode Island online casinos for real money play?

BetUS, Wild Casino, and Raging Bull are our top offshore options for players. They offer gaming variety, higher rewards, and secure gaming sessions on both desktop and mobile devices.

Can Rhode Island residents join offshore online casino sites?

Yes, Rhode Island residents can join offshore casinos operating online in Rhode Island without any legal consequences as these platforms legally accept US players.

What payment methods are accepted at Rhode Island online casinos?

Payment methods at offshore Rhode Island casinos include credit/debit cards, bank transfers, e-wallets, and cryptocurrency options like Bitcoin. State-regulated casinos, like those owned by Bally’s, typically support traditional methods like cards and online banking.

Are there Rhode Island casino apps for mobile play?

Yes, most offshore casinos, including BetUS, provide optimized mobile platforms accessible from browsers rather than dedicated mobile apps. Bally’s platforms may also offer mobile compatibility through their website or a dedicated mobile casino app.

How does Rhode Island’s gambling law compare to neighboring states?

Rhode Island’s laws allow for only one state-regulated online casino operator, unlike Connecticut's competitive multi-operator model. At the same time, US states like Massachusetts and New York have much stricter gambling restrictions.