Best Illinois Sports Betting Sites & Apps 2025

Illinois legalized sports betting in 2020. But you don’t have to stick with just the local US options. Sure, local Illinois sportsbooks in the US are easy to access. But they’re not always the most competitive. Offshore sportsbooks often offer better odds, bigger bonuses, and a wider range of bets. That’s why many savvy players are turning to Illinois sports betting sites based offshore. These sites are fully licensed, safe, and welcome players from Illinois without issues.

These Illinois online sportsbooks accept players from the state and are packed with better promos, faster payouts, and deeper markets. They’re especially strong if you like niche sports or want to dive into the action with live betting. The bottom line? You’ve got choices. Whether you’re chasing the best Illinois betting apps or exploring online sports betting in Illinois, we’ve got you. We’ve broken everything down so you can bet smart and stay safe.

Best Illinois Sports Betting Sites by December 2025

- All

|

BetUS Sports |

125% Bonus on First 3 Deposits |

125% Bonus on First 3 Deposits

|

|

PLAY NOW

NO CODE REQUIRED

|

|

BetWhale Sports |

Up To $1,250 Sports Betting Welcome Bonus |

Up To $1,250 Sports Betting Welcome Bonus

|

|

PLAY NOW

NO CODE REQUIRED

|

|

BetNow Sports |

125% Welcome Bonus - Up to $2,500 |

125% Welcome Bonus - Up to $2,500

|

|

PLAY NOW

NO CODE REQUIRED

|

|

BetOnline Sports |

Get Up to $250 in Free Bets |

Get Up to $250 in Free Bets

|

|

PLAY NOW

NO CODE REQUIRED

|

|

MyBookie Sports |

50% Deposit Match Up To $1,000 |

50% Deposit Match Up To $1,000

|

|

PLAY NOW

NO CODE REQUIRED

|

|

Everygame Sports |

100% Signup Bonus Up to $200 |

100% Signup Bonus Up to $200

|

|

PLAY NOW

NO CODE REQUIRED

|

|

BUSR Sports |

100% Welcome Bonus Up To $2,500 |

100% Welcome Bonus Up To $2,500

|

|

PLAY NOW

NO CODE REQUIRED

|

|

SportsBetting |

50% Deposit Match Bonus Up To $1,000 |

50% Deposit Match Bonus Up To $1,000

|

|

PLAY NOW

NO CODE REQUIRED

|

|

XBet Sports |

Get $200 in Bonus Bets |

Get $200 in Bonus Bets

|

|

PLAY NOW

NO CODE REQUIRED

|

|

Bet105 Sports |

50% Deposit Match Up To $100 |

50% Deposit Match Up To $100

|

|

PLAY NOW

NO CODE REQUIRED

|

Is Sports Betting Legal in Illinois?

Yes, sports betting in Illinois is fully legal, both in-person and online. The state rolled out regulated sportsbooks in 2020. You can now place bets via apps or at retail locations across Illinois.

| Type | Availability |

|---|---|

| Retail Sports Betting | ✅ |

| Online Sports Betting | ✅ |

| In-State Online Sportsbooks | ✅ |

| Horse Racing | ✅ |

| College Sports Betting (In-State Teams) | ✅ |

| Esports | ✅ |

| Politics | ❌ |

| Entertainment | ✅ |

Current Legal Standing of Illinois Sports Betting

Sports betting in Illinois was officially legalized when Governor J.B. Pritzker signed the Illinois Sports Wagering Act into law on June 28, 2019. This legislation was part of a broader $45 billion capital infrastructure plan known as Rebuild Illinois. It offers nationwide online and in-person wagering options. Players can place bets through licensed Illinois sports betting apps or retail sportsbooks at casinos and stadiums.

The Illinois Gambling Act allows betting on professional sports, out-of-state college games, and a growing list of niche markets like esports. The Illinois Gaming Board oversees all licensed platforms and enforces strict rules around security, fairness, and responsible gambling. Whether using a mobile sportsbook or visiting a retail location, you’re betting within a fully legal and regulated framework.

Recent Illinois Sports Betting Legislation Changes

In 2024, Illinois updated its tax structure for sportsbooks, moving from a flat 15% rate to a graduated system based on revenue. The new top-tier taxes on high-earning sportsbooks are up to 40%, aiming to increase state revenue from the fast-growing sports betting market.

Another key change affects college sports: as of July 2024, betting on in-state college teams is no longer permitted, even at retail locations. This move aligns Illinois with several other states and is intended to safeguard the integrity of college athletics.

When Did Illinois Legalize Online Sports Betting?

Illinois legalized sports betting in June 2019 with the passage of the Illinois Sports Wagering Act. Retail sportsbooks launched in March 2020, just before the COVID-19 pandemic. Online sports betting followed shortly after, initially requiring in-person registration at retail locations.

That restriction was lifted in March 2022, allowing users to fully register and bet online without visiting a casino. This shift led to a significant surge in participation, making Illinois one of the top sports betting markets in the U.S. today. Players now enjoy easy access to licensed IL sports betting apps offering odds on everything from major leagues to fantasy contests and live bets.

Can you Bet on IL Online Casinos

IL online casinos are not yet legal for real-money play, but Illinois players can still access offshore platforms for the casino experience. These sites use virtual credits and offer a legal way to enjoy slots and table games while lawmakers continue to debate full iGaming legislation.

How Do the Gambling Laws in Illinois Compare with Neighboring States?

When it comes to online sports betting in Illinois, the state leads the way in the Midwest. Illinois sets a strong standard with full regulation, mobile access, and competitive markets. Here’s how it stacks up against nearby states:

Indiana

Indiana sports betting was legalized shortly before Illinois and includes both online and retail options. However, Indiana imposes tighter restrictions on esports and college player props. While the overall market is strong, Illinois sportsbooks tend to offer more variety, especially regarding niche bets and in-game wagering.

Iowa

Iowa sports betting is legal and offers retail and mobile access without requiring in-person registration. Illinois sportsbooks often lead in promotions, betting features, and market depth. For experienced players, Illinois generally provides a more robust and user-friendly betting environment.

Missouri

Missouri sports betting remains in a holding pattern. Although legislative efforts continue, no legal sportsbooks are operating in the state. That gives Illinois sports betting a significant advantage—players in Illinois can legally place bets today, while those in Missouri still wait for legislation to pass.

Wisconsin

Wisconsin sports betting is legal only in retail settings and only through select tribal casinos. There is no state-regulated online betting, which significantly limits access. In contrast, Illinois sports betting is fully mobile, regulated, and offers a far wider range of markets—making it the more convenient option for most bettors.

Can You Play at Online Sportsbooks in Illinois?

Yes, you can — and legally, too. While the state runs its own regulated market, Illinois sports betting isn’t limited to just in-state options. You’ve also got access to top-tier offshore betting sites that are fully licensed and have been trusted by players for years. These platforms welcome bettors from Illinois and offer a reliable, secure way to wager without breaking any laws.

One big perk? No frustrating KYC hoops to jump through. Unlike local apps, these no-KYC betting sites don’t require many documents to open an account. That means you can dive into Illinois sports betting without delays — and with better odds, faster payouts, and more freedom. If you’re serious about Illinois sports betting, offshore sportsbooks are a smart, safe choice with way less hassle.

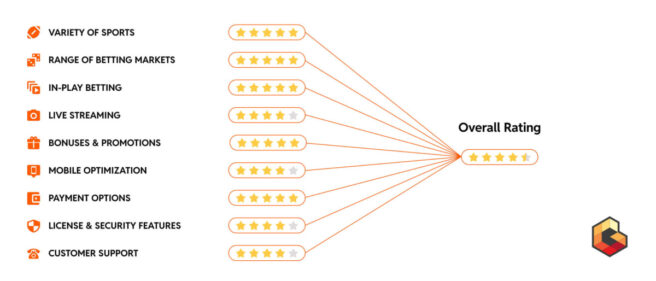

How We Rank the Best Illinois Sportsbooks

We don’t just list any site — our expert team carefully reviews and ranks each platform before it makes the cut. When we evaluate IL sportsbooks, we look at things like trustworthiness, payout speed, bonus quality, and overall user experience. It’s all part of how we rank the sites that actually deliver value. We want to give Illinois players the best shot at a smooth, secure betting experience.

Top 3 Illinois Betting Sites for 2025

Looking for the best spots to place your bets in Illinois? We’ve got you covered. We’ve sifted through the options to highlight the top three Illinois sports betting sites. They offer great odds, user-friendly interfaces, and reliable payouts.

Let’s dive in and see which platforms stand out in 2025.

1. BetOnline – Best IL Sportsbook for Fast Crypto Payouts

- Welcome Offer: 150% Up To $5,000

- Promo Code: FREE250

BetOnline has been around since the early ’90s, and it shows. This is a sportsbook that knows what it’s doing — clean layout, fast load times, and a no-nonsense betting experience. You’ll find a smooth mobile platform, 24/7 live chat support, and a VIP system that actually feels rewarding.

Betting markets at BetOnline go deep. From NBA playoffs and UFC main cards to niche picks like Age of Empires esports or minor league tennis — it’s all here. Auto odds boosts, Same Game Parlays, and a packed live betting section make it feel dynamic and always moving. Illinois fans can bet on the Cubs, Bulls, Bears, or Illini with ease, and MLB fans will appreciate just how many baseball props get listed daily.

When it comes to promos and payments, BetOnline delivers. The welcome deal gets you up to $250 in Free Bets plus 100 Free Spins, with no rollover headaches. You can deposit with Bitcoin, Ethereum, Litecoin, or even Dogecoin, and payouts are often processed the same day. Prefer cards? BetOnline also supports Visa, Mastercard, and Discover, all without any unnecessary friction.

2. BetNow – Reliable Sportsbook With Years of Experience Serving Illinois Players

- Welcome Bonus: 200% crypto up to $200 / 150% fiat up to $225 / 100% fiat up to $500

- Promo Codes: CRYPTO200 / BN150 / BN100

For Illinois players looking for a dependable alternative to state-licensed apps, BetNow offers a stable and proven platform. Operating for over a decade and licensed by the Anjouan Union of the Comoros, BetNow is a trusted name with a long-standing commitment to fairness and player protection. That level of consistency gives Illinois bettors a secure space to enjoy real money sports wagering.

The user experience is straightforward from the moment you sign up. Navigation is clean, betting options are easy to access, and there’s no hassle when it comes to deposits or withdrawals. Whether you’re betting on the Bears, Bulls, or international events, BetNow keeps everything quick and user-friendly.

Illinois sports betting fans can also take advantage of flexible welcome offers tailored to their preferred payment method—crypto or fiat. Regular promotions, a rewarding rebate program, and contests with real cash prizes make BetNow more than just another sportsbook. It’s a value-packed choice for bettors who want a smoother, more rewarding experience from start to finish.

3. Everygame – Best IL Sportsbook for Classic Coverage & Crypto Perks

- Welcome Offer: 50% Up To $1,000 (Crypto)

- Promo Code: CRYPTO1K

Everygame is a sportsbook built for bettors who want solid, straightforward coverage without the fluff. It’s been around for decades and has stayed relevant by doing the simple things well — a clean site, quick load times, and a range of promos that don’t overpromise. You can bet pre-game, in-play, or even at halftime, and the layout makes it easy to jump between markets without getting lost. It’s sharp, smooth, and ideal for bettors who value function over flash.

Sports selection is broad without being bloated. You’ll get all the usuals — NFL, NBA, MLB, and NHL — but Everygame also slips in less common markets like darts, cricket, Aussie Rules, and halftime-specific bets. If you’re after flexibility, the live betting here is super responsive. Props include player yards, runs, and scoring stats.

Payments are where Everygame really opens up. Crypto users get the best deal with a 50% match up to $1,000. For fast and private transactions, you can deposit using Bitcoin, Bitcoin Cash, Litecoin, and Lightning Bitcoin. Prefer cards or local methods? Visa, Mastercard, American Express, and Discover are all good to go. The range is solid, the setup is secure, and cashouts don’t drag.

Popular Teams & Events To Bet On In Illinois

When it comes to betting sites in Illinois, local fans tend to back their teams hard, especially when it’s time for game day. From major league showdowns to in-state rivalries, the action runs deep. And if you’re using IL online sportsbooks, you’ll find player props, futures, and game lines up well ahead of time.

Chicago Bears (NFL)

The Bears are the heart of NFL betting in Illinois. Whether you’re backing the moneyline or betting on player props like passing yards for Justin Fields, markets are consistently active. Prime-time games, divisional matchups, and NFC North rivalries always see a spike in action, especially during the lead-up to the postseason.

Chicago Bulls (NBA)

Illinois bettors stay locked in during the NBA season, and the Bulls are front and center. With 82 games plus the chance for playoff runs, there’s a daily opportunity for player props, first basket markets, and live betting. DeMar DeRozan and Zach LaVine props are often among the most played in-state.

Chicago Cubs & Chicago White Sox (MLB)

Baseball runs deep in Illinois, and both fan bases bring serious volume. The Cubs attract big summer action, especially with Wrigley Field games on the calendar. White Sox fans lean into alternate run lines and team totals. During interleague and cross-town matchups, these games often dominate the local betting handle on IL sportsbooks.

Illinois Fighting Illini (NCAA)

The Fighting Illini draw strong support during both football and basketball seasons. With consistent appearances in March Madness and Big Ten football showdowns, they’re a go-to for college fans using IL online sportsbooks. While state laws restrict some prop bets, futures, spreads, and team totals on Illini games still attract regular action.

Responsible Gambling Resources in Illinois

IL Gambling Help

Illinois sports betting can be exciting and rewarding, but it’s important to keep things in check. That’s why setting personal limits and knowing when to take a break is a must for anyone engaging in Illinois sports betting.

Whether you’re betting occasionally or are fully immersed in Illinois sports betting, these resources are here to support you:

- Illinois Department of Human Services – Gambling Services

- National Council on Problem Gambling – Get Help

- Gamblers Anonymous – Illinois Meetings

Make sure your Illinois sports betting experience stays positive — and don’t hesitate to reach out if things ever feel off.

Illinois sports betting can be exciting and rewarding, but it’s important to keep things in check. That’s why setting personal limits and knowing when to take a break is a must for anyone engaging in Illinois sports betting.

Whether you’re betting occasionally or are fully immersed in Illinois sports betting, these resources are here to support you:

- Illinois Department of Human Services – Gambling Services

- National Council on Problem Gambling – Get Help

- Gamblers Anonymous – Illinois Meetings

Make sure your Illinois sports betting experience stays positive — and don’t hesitate to reach out if things ever feel off.

Conclusion: The Best IL Sportsbooks

After reviewing the top platforms, BetOnline stands out as our number one pick. It’s smooth, fast, and incredibly reliable — especially for anyone frustrated by the limits of online betting in Illinois. You get a clean user experience, sharp odds, deep markets, and none of the state-imposed restrictions that come with local options. Offshore sites like this let you bet on in-state college teams, use crypto freely, and avoid the red tape tied to credit card bans or prop bet limits.

Plus, with the new progressive tax model hitting local sportsbooks hard, more players are exploring what betting sites are legal in Illinois beyond the regulated market. Platforms like BetOnline come fully licensed, offer strong bonuses, and don’t skimp on features — whether you’re placing MLB futures, college football props, or even specialty odds like “Who will be the new Pope?” With better promos, more freedom, and no legal risk, they’re a smart choice for anyone serious about getting the most from online betting in Illinois.

At GamblingIndustryNews, we are committed to promoting responsible gambling. We encourage our readers to play responsibly, never chase losses, and be aware of features like self-exclusion programs that help players to maintain control over their gambling activities and promote a balanced experience. At GamblingIndustryNews, we are committed to promoting responsible gambling. We encourage our readers to play responsibly, never chase losses, and be aware of features like self-exclusion programs that help players to maintain control over their gambling activities and promote a balanced experience.Responsible Gambling

Illinois Sports Betting FAQs

Does Illinois have legal sports betting?

Yes, Illinois sports betting is fully legal. Both online and in-person wagering are allowed through licensed operators. Residents can place bets on professional and college sports, making Illinois one of the most active betting markets in the Midwest.

What Illinois sports betting apps are legal and regulated?

Several licensed Illinois sports betting apps are available to residents, including some of the biggest names in the industry. These apps require players to be physically located within state borders and comply with local rules such as identity verification and betting restrictions on certain markets.

When did Illinois legalize sports betting?

Sports betting was legalized in Illinois with the passage of the Sports Wagering Act in 2019. Retail sportsbooks launched in March 2020, followed shortly by the rollout of online platforms. The market has grown rapidly ever since, with more apps and options available each year.

Can you place college player props in Illinois?

No, Illinois betting laws prohibit prop bets on individual college athletes through state-regulated platforms. However, many offshore sportsbooks that accept Illinois players do allow college player props, offering broader betting opportunities for NCAA fans.

Can you bet on politics or entertainment in Illinois?

Political betting is not allowed through Illinois-licensed sportsbooks, but some entertainment markets—like major award shows—may be available. For a wider range of betting categories, including politics and pop culture events, many international sportsbooks serving Illinois provide more variety and flexibility.